Credit Reporting Services – Are Paid Choices Better Than A Free Credit Report?

There is not a whole lot you can do for negative credit as it can take years to get it repaired. When you do whatever you are supposed to do, this is true also. It is not as very easy as you believe to contest something you locate at fault on your credit report. You will be checked out greater than the business that made the error.

Even every six months is way to long to postpone in my estimate. These days, you can get a Free Credit Report tomorrow and after that someone hijacks your identification in a couple of days from currently and also completely wrecks your credit over the next 4 or 5 months as well as by the end of the year, your credit is devastated! What would you do if you are that target?

Seeking task? Much better wish you have a respectable FICO score. Nowadays potential employers are getting your rating in an effort to forecast what kind of employee you will be. Apartment or condo supervisors as well as land lords will likewise use this number to determine whether or not you will certainly pay the rental fee on schedule.

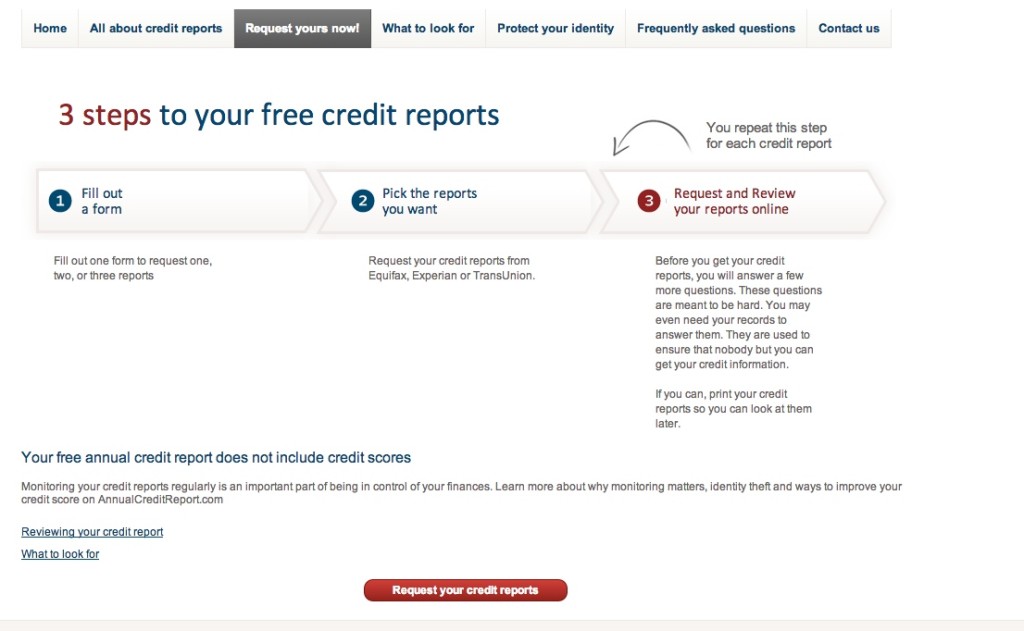

Nevertheless, before you begin functioning on this concern, it is very important that you have a clear concept concerning exactly where you stand. Keep in mind, unless you know just how low your credit report has sunk, you will not have the ability to do the necessary. This is why you need to choose the free reports online. That will certainly give you a clear suggestion about what distress you are in as well as guide you to take action accordingly.

There are numerous online credit firms that will certainly give you with a duplicate of your credit report for free. Yes I will certainly agree some of them are bent on make cash from you but not every one of them. There are websites that are providing an authentic service total with various other benefits that you can utilize too. Getting a report is not almost considering it and not understanding what to do with the information.

Among the secured ways for the financial lending firms is by checking your credit report. However, what by the way is credit report? It is actually a record or history of your past credit transactions consisting of all the poor documents such as late payments and bankruptcy. When you loved this informative article and you would like to receive more information concerning theloanrepublic generously visit our own web site. So, try to imagine if you have a negative credit standing, all of those can transparently be seen by the borrowing companies. Also included in the credit report is, obviously, the history of your punctual repayment (if you are an excellent payer). The information in your credit record will determine your credit online reputation or your credit rating. The borrowing business will depend upon your credit score whether to accept your car loan or otherwise.

Do examine the report to figure out if there is a mistake or not, and if there is, then you ought to bring it to their notification. It is a great idea to inspect all the three independent reports. It is an excellent idea to inspect all the 3 documents also when you make sure that there can not be any black area in them.

If you are declined for insurance coverage you need to do the exact same point as number 3. Onward a duplicate of the insurance rejection or cancellation notice to the credit bureaus and request for a free report.